Statement

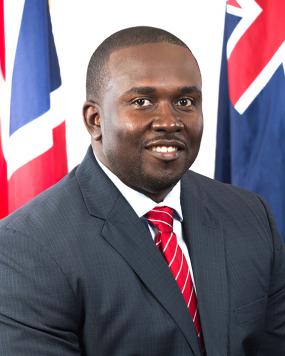

INTERVENTION BY JUNIOR MINISTER FOR TRADE,INVESTMENT PROMOTION AND CONSUMER AFFAIRS

HONOURABLE MARLON A. PENN

36TH SESSION OF UNITED NATIONS ECONOMIC COMMISSION FOR LATIN AMERICA AND THE CARIBBEAN (UNECLAC)

MEXICO CITY, MEXICO

24TH MAY 2016

Madam Chair, Honourable Ministers and delegates,

Madam Chair, Honourable Ministers and delegates,

It is my privilege to make this intervention today on behalf of Premier and Minister of Finance of the British Virgin Islands (BVI), Dr. the Honourable. D. Orlando Smith, OBE.

The BVI as an Associate Member of ECLAC highly values our relationship with the regional commission. We are the oldest Associate Member of ECLAC, having joined in 1984. The presence of a BVI delegation here at this biennial meeting in Mexico City is a testament to our lasting commitment to ECLAC and desire for greater economic integration in Latin America and the Caribbean going forward.

Importantly, Associate Members have a different political status than full Members. However, this does not change the fact that Associate Members as islands face the same set of developmental challenges as the independent small island developing states (SIDS). ECLAC support for Associate Members such as BVI is important to help address issues such as the negative impacts of climate change and the conservation of marine biodiversity. These are challenges too great for any of the SIDS to address on their own, regardless of political status.

Also, in the area of health, pandemics such as Zika do not discriminate between Associate Members and full Members. Viruses and diseases that go unchecked across borders will discourage tourists from visiting any of our countries and territories on whom our economies depend for economic growth. Moreover, Associate Members are also affected by issues such as de-risking by international banks that threatens correspondent banking in the Caribbean. ECLAC support for its large block of 13 Associate Members can distinguish it from other UN and international bodies in terms of greater inclusion. There is also much that Associate Members can offer to ECLAC with our own experience in development, which can be shared to the benefit of others.

Mrs. Diane Quarless and her team at the ECLAC Subregional Office in Port-of-Spain have made every effort to ensure Associate Members participation in ECLAC and BVI is grateful.

Additionally, the BVI is also a member of ECLAC's permanent subsidiary body for the Caribbean, the Caribbean Development Coordinating Committee (CDCC) on which BVI serves as a Vice Chair. I would like to take this opportunity to thank CDCC Chairman Hon. Mark Brantley, Foreign Minister of St. Kitts and Nevis, for his and CDCC's overwhelming support for the greater inclusion of Associate Members in ECLAC's programmes and activities, which will support their economic and sustainable development.

Madam Chair, as financial services is one of the main economic pillars of the BVI economy and wider Caribbean, it is essential that I set out here the BVI’s position on this sector.

In recent weeks all things so-called offshore have been tarnished by the imbalanced news coverage of the Panama Papers. In the media frenzy, the lawful and legitimate role that the BVI and other International Finance Centres (IFC) play in the global financial system has been overlooked.

The BVI is a leading IFC which contributes positively to the world economy by facilitating the efficient pooling of capital by international investors, which is then invested largely in developing and emerging economies in critical sectors such as infrastructure. This supports the growth of trade and commerce and creation of jobs. The BVI is proud of this role. We are also proud to be the headquarters of the Eastern Caribbean Commercial Court, which speaks to the strength of the rule of law in the jurisdiction and the depth of professional and legal expertise readily available, which makes the BVI an attractive place for business.

Importantly, the financial services in the BVI is a well-regulated industry. The jurisdiction has led the way in implementing regulatory and compliance standards that support the needs of a modern, interconnected global economy and are comparable and even more advanced than those of many other jurisdictions. We do not tolerate the abuse of our corporate structures and take decisive action when wrongdoing is identified.

It is important to note that the BVI strikes an appropriate balance between transparency and privacy. In terms of corporate structures, basic company information is available at the companies house. Any information not in the public domain is available to foreign law enforcement and tax authorities via established tax and beneficial ownership information exchange regimes. This is underscored by the BVI's 28 bilateral Tax Information Exchange Agreements (TIEA) with mostly OECD countries; our participation in the OECD Multilateral Convention on Mutual Administrative Assistance in Tax Matters, which includes 76 other jurisdictions; and our information exchange regime with the 120 other jurisdictions that are members of the Egmont Group of Financial Intelligence Units.

The BVI’s compliance with international standards is recognised by the established international standard setting bodies such as the Financial Action Task Force (FATF). We are compliant with FATF standards on beneficial ownership of companies, which is the standard adopted by the large majority of the world’s jurisdictions.

The OECD Global Forum has also rated the BVI largely compliant on tax transparency, which is the same rating received by Germany and the UK. The BVI was also one of the Early Adopters of the OECD's new Common Reporting Standard on the automatic exchange of tax information with other jurisdictions. We are also a full member of the International Organisation of Securities Commission (IOSCO).

While BVI is compliant with existing international standards, I want to make clear that we stand ready to adopt new universally agreed international standards on tax and transparency, which we wish to be a partner with other jurisdictions in developing.

Financial Services in the BVI and wider Caribbean is a legitimate economic sector that should be sustained and not illegitimately attacked.

As I close, I would like to take this opportunity to thank ECLAC Executive Secretary Ms. Alicia Barcena and Deputy Executive Secretary Mr. Antonio Prado for their support for the deepening of the BVI's and other Associate Members' economic integration into ECLAC.

Thank you for your patience.