Information Officer II

Dept. of Information & Public Relations

Telephone: 468- 2740

Email: shersmith@gov.vg

Press Release

The International Tax Authority (ITA) is informing all BVI Financial Institutions (BVIFIs) that the BVI Financial Account Reporting System (BVIFIs) is back online post hurricanes Irma and Maria.

The International Tax Authority (ITA) is informing all BVI Financial Institutions (BVIFIs) that the BVI Financial Account Reporting System (BVIFIs) is back online post hurricanes Irma and Maria.

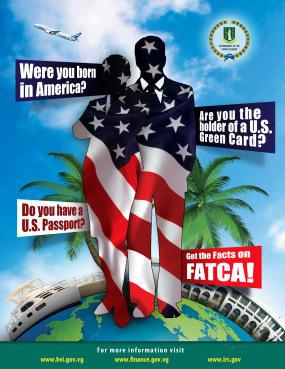

Financial institutions are reminded that May 31, 2017 was the deadline for reporting submissions for 2016 under the US Foreign Accounts Tax Compliance Act (US FATCA)and was extended to September 1, 2017under the Common Reporting Standards (CRS).Reporting submissions for US FATCA and CRS should have been submitted by those dates, unless, prior arrangements were made with the International Tax Authority and had been advised otherwise.

Financial institutions that have not submitted their filings for 2016 are now encouraged to do so immediately. These institutions may be subject to penalties, in accordance with section 21 of the Mutual Legal Assistance (Tax Matters) Act, 2003 as amended, for not complying with the deadline.

The statutory deadline for reporting submissions for 2017 filings for both US FATCA and CRS is May 31and BVI financial institutions are encouraged to make every effort to comply with this deadline.

TheITA has released an updated version of the BVIFARS User Guide, version 9.0, which is available on thewebsite: http://www.bvi.gov.vg/fatca. Also, the updated lists of participating jurisdictions and reportable jurisdictions for the Common Reporting Standards will be published shortly in the Virgin Islands Gazette and made available on the website once gazetted.

The ITA also expresses good wishes and a productive 2018 to all BVI Financial Institutions (BVIFIs) and thanks them for their patience as the Authority worked to get the system back online.

For further information please visit our website: http://www.bvi.gov.vg/fatcaor contact us on telephone number1 (284) 468 4415 or email: bvifars@gov.vgor bviita@gov.vg.