Statement

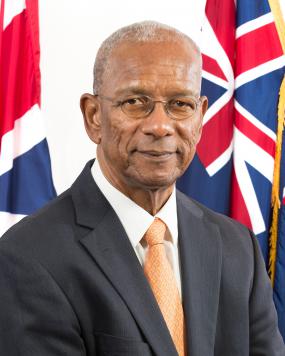

STATEMENT BY THE HONOURABLE PREMIER AND MINISTER OF FINANCE DR. THE HONOURABLE D. ORLANDO SMITH, OBE DURING THE FOURTH SITTING OF THE FIRST SESSION

OF THE THIRD HOUSE OF ASSEMBLY OF THE VIRGIN ISLANDS

MONDAY, 2ND NOVEMBER, 2015

10:00 A.M.

Beneficial Ownership of Companies

Madame Speaker, at this time, I would like to update this Honourable House on where we are with the issue of transparency as this relates to Beneficial Ownership of Companies.

Madame Speaker, at this time, I would like to update this Honourable House on where we are with the issue of transparency as this relates to Beneficial Ownership of Companies.

the British Virgin Islands’ financial services industry has long enjoyed a reputation of being a pre-eminent financial services jurisdiction; offering a myriad of corporate and other structures; but we are particularly best in class for our company incorporation regime.

As such we have built a solid industry which helps to facilitate global trade and international capital flows.

Our success is underpinned by a strong regulatory and compliance regime that meets global standards and aims to protect the jurisdiction and the global community from persons who may seek to abuse our business structures.

To this end, as a jurisdiction, we have always, through the continual review and reform of the appropriate legislative and administrative frameworks, strived to ensure that our regime is fit for purpose, internationally compliant, and can serve the legitimate business needs of our industry’s clientele. Indeed I am pleased that this House over the years has adopted a non- partisan approach to legislative matters involving this industry to ensure just that.

We have also long given due regard to the developing global trends which impact or have the potential to impact the Territory’s financial services sector including the current global issues related to transparency.

This is why successive Government administrations in this Territory, including my present Government, have over the years continuously strengthened our law enforcement, international cooperation and, most recently, effective exchange of information in the areas of tax, to keep in tune with developments and guard against activities considered inimical to the financial services sector and the reputation of the Territory.

However, Madam Speaker, as members are well aware, over these last few years, the BVI’s industry has come under intense scrutiny and pressure from the United Kingdom, G7, OECD and other international bodies, -- each with a strong focus on corporate transparency regarding beneficial ownership.

Let me add some context to the issue:

In Spring 2013 Prime Minister David Cameron wrote to the leaders of the Overseas Territories, indicating the UK’s government intentions that the Overseas Territories (OTs) and Crown Dependencies (CDs) along with the UK should establish central registries of the beneficial owners of companies and that these registries should be made publicly available.

The Overseas Territories collectively agreed to support the UK’s G8 Agenda on transparency and committed to produce action plans on beneficial ownership. However, the consensus amongst the OTs and the CDs of the UK was that, further consultation and consequential discussions must be had before a final decision could be reached on the matter.

Madam Speaker, I previously informed this Honourable House that in July 2013, the Territory issued an action plan to prevent the misuse of legal persons. Among other things, the plan committed the BVI to review its legislation and systems, in consultation with its stakeholders with a view to full compliance with Financial Action Task Force (FATF) recommendations (24 and 25) on the beneficial ownership of legal persons.

Furthermore, with regard to the issue of a central registry, after a full consultation with the industry on whether the BVI should establish a central registry to hold beneficial ownership information; I laid in this Honourable House a report from that consultation which showed that our industry and other stakeholders were not in favour of a public central register.

The industry maintained a high confidence in the jurisdiction’s existing beneficial ownership regime. The findings also found that our system achieves the same outcomes as a central register, using an equally effective mechanism – our corporate services provider regulatory regime.

At that time we concluded that our current regime — subject to some modifications — provides an effective mechanism which complies with the standard on beneficial ownership information.

All of the other OTs made similar conclusions and in the lead up to, as well as subsequent to our Joint Ministerial Council meeting with the UK Government in 2014 we reiterated our position that we are not in favour of public central registries.

Let me point out here that while the UK Government has opted for a public central register which will make the ownership of companies available centrally to the public at large, this approach has not been widely adopted internationally. It should be noted; however, that the UK Government acknowledges that similarly effective systems could be utilised.

Coming out of Joint Ministerial Council (JMC) meeting 2014, however, the Territories and the UK did commit to continue to work together in raising international standards to tackle money laundering, tax evasion, illicit finance and corruption, agreeing to continue discussing beneficial ownership within the framework of implementing the G20 High-Level Principles on Beneficial Ownership Transparency. This would require jurisdictions to have either central registers or equivalent mechanisms to ensure timely access by law enforcement and tax authorities.

Madam Speaker, we all know that BVI has always had a good history of being a compliant and cooperative jurisdiction. Any recommendations that arose from international assessments, evaluations and reviews were always considered and implemented, as appropriate.

In fact, we have always kept pace with new and evolving standards thereby ensuring that we have effective regimes, be it for regulatory purposes, for transparency or for facilitating international cooperation.

My Government continues to recognise the evolving international standards of transparency as promoted by the FATF and the OECD, as well as the aims of the Government of the United Kingdom.

So Madam Speaker, over the past year and more we have been working internally through an ad-hoc Committee which I Chair to determine how we will improve transparency of our regime.

We have also engaged our local and international partners to help determine how we will further develop our regime to become complaint with international standards.

At the same time, the Financial Services Commission, as the competent authority for BVI regulatory standards has also promulgated its proposals for compliance with the international standards.

I am pleased to inform this Honourable House that we have agreed on a policy direction which will:

strengthen the existing Corporate Service Provider (CSP) model to meet the revised FATF standards with regard to beneficial ownership and address any weakness in the system; and,

Increase the speed of access to beneficial ownership information by competent authorities.

In another statement I will elaborate on and introduce the regulatory/legal changes to our regime to give this policy direction effect; by enhancing the AML/CFT regulatory regime.

But Madam Speaker, we have been busy on other fronts. The issues of beneficial ownership, transparency and AML are inextricably related. Indeed transparency of beneficial ownership is critical to deterring criminality; as well as investigating and co-operating with law enforcement and other competent authorities.

So, we are well on our way to completing our National Risk Assessment to identify and implement measures to strengthen our anti-money laundering and counter terrorist financing regime.

The UK Government and many other countries are moving in this direction, as well. In fact, just recently, in October, the UK launched its first money laundering and terrorist financing national risk assessment to identify, understand and assess the risks faced by the UK.

It means that we all understand how money laundering and terrorist financing has the potential to threaten the integrity and undermine the stability of our financial markets and institutions.

Madame Speaker, our Financial Services Commission has been also doing its part to seek new ways of improving regulatory oversight and monitoring of Registered Agents.

In supporting greater transparency, we have been in consultation with industry partners regarding effective and efficient ways of filing of registers of directors in the Registry of Corporate Affairs.

Madame Speaker, the crux of the beneficial ownership issue is to ensure that we know who beneficially own BVI companies and to have the ability to share that information with competent authorities and law enforcement in a very timely manner when necessary.

We are well aware that the G20 principles on beneficial ownership accommodate different ways of delivering an effective system in this regard. We intend to build upon our current system to ensure that it is fully responsive and efficient to comply with the international standards.

Since last JMC, Madam Speaker, we have been engaged with Her Majesty's Government very constructively on this issue and we continue to do so. Moreover, the OTs have are collectively engaged on the UK’s transparency agenda.

In a few weeks, I and other leaders will meet with the UK Government Ministers and officials at the JMC meeting. We will once again take the opportunity to update officials on what we have been doing to adopt an approach that is effective in the BVI context; but which is compliant and satisfies the objectives of the standards.

I can say unequivocally that the BVI will continue to improve our regime to meet the international standards. We have always done so, as sovereignty over our fiscal affairs including financial services from its inception have remained within the purview of the Government of the Virgin Islands.

We will continue to monitor the evolution of global standards and best practices and sustain our engagement with the industry to ensure that the BVI remains a pioneering, vibrant and competitive financial jurisdiction for global business.

Thank you, Madam Speaker.